Condominium and townhouse prices in the Las Vegas Valley hit a record high in April, according to statistics from the Las Vegas Realtors, who pull numbers from the Multiple Listing Service.

The median price of a condo or townhouse sold in the valley last month was $290,000, a 7.4 percent increase from April of last year. This broke the all-time high set back in August 2022, when the average property sold for $287,000.

The number of condos and townhomes on the market is also up 10.7 percent from April of last year, which is a 3.8 percent increase from March. New listings of these types of properties also are on the rise, as there was a 5.9 percent increase from March, which is a 29.5 percent increase from April of last year.

And demand for housing appeared to be up in April in general as 2,960 existing homes, condos and townhomes sold in April. That’s a 12.3 percent increase in single-family home sales over the previous month, according to Las Vegas Realtors, and a 19.2 percent increase from April 2023. Condo and townhome sales jumped 16 percent over the same month last year.

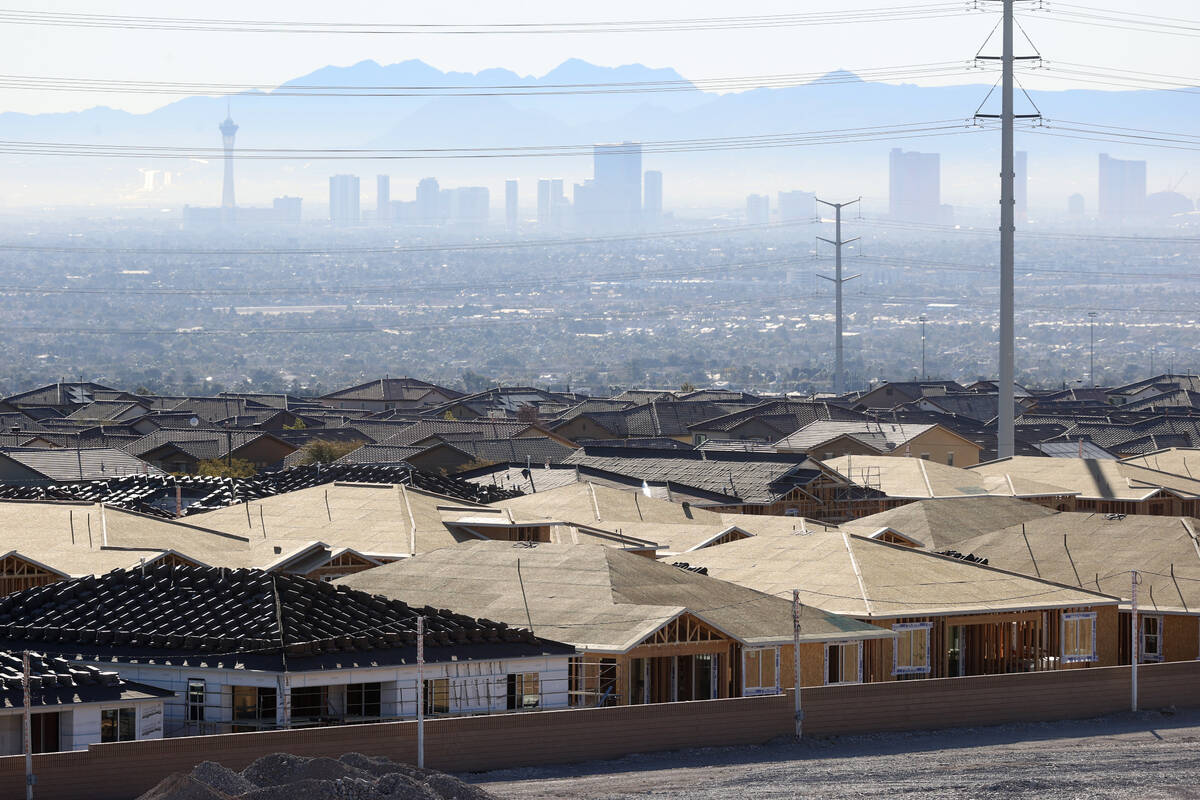

“Mortgage rates have been slowing down home sales this year, so it’s good to see more homes and condos selling,” LVR President Merri Perry said in a statement. “Overall, demand continues to outpace the supply of homes here in Southern Nevada, and that’s driving up prices.”

The real estate market across the country continues to become more unaffordable for average Americans as Redfin reported recently that low-income homebuyers are obtaining mortgages with much less success, a 23 percent drop from 2020. This means more sales are going to affluent buyers, a trend that has been supercharged since last year as interest rates skyrocketed.

“The small bit of progress that Americans earning very low incomes made on taking out mortgages at the start of the pandemic has also been erased,” the report stated. “Just under 6 percent of new mortgages issued last year went to very low income Americans, down from 7.7 percent in 2020. Very-low-income Americans now make up a smaller percentage of mortgage borrowers than they did in 2018 (7.1 percent).”

Redfin’s report also said that high-income homebuyers are continuing to get mortgages even though rates are high, and continuing to buy up more of America’s housing market.

“There was a sweet spot in 2020 when mortgage rates were ultra low and home prices had yet to skyrocket, allowing some lower-income Americans to break into the housing market,” Redfin senior economist Elijah de la Campa said in a statement. “But somewhat ironically, the continued strength of the economy has made it harder to afford a home and widened the real-estate wealth gap between rich and poor Americans. The Fed’s interest-rate hikes, meant to help cool inflation and slow a hot economy, have pushed mortgage rates to near their highest level in more than two decades. That’s on top of home prices, which skyrocketed during the pandemic buying boom and have stayed high due to a shortage of homes for sale.”

Contact Patrick Blennerhassett at pblennerhassett@reviewjournal.com.